Stamp Duty Holiday

Stamp Duty, also known as Stamp Duty Land Tax (SDLT), is a charge that applies when purchasing a residential property in the UK.

On 3rd March the Government announced that homebuyers in England and Northern Ireland will not need to pay stamp duty on homes up to £500,000 until 30 June 2021.

This stamp duty holiday applies to both first-time buyers and those who have previously owned a home.

The threshold for which you start paying Stamp Duty is set to change on several key dates this year:

- Until 30th June: You'll pay no Stamp Duty on the first £500,000 of a main residence.

- 1st July to 30th Sept: You'll pay no Stamp Duty on the first £250,000 (up to £300,000 for first-time buyers) of a main residence.

- From 1 Oct: Stamp Duty thresholds will return to their usual levels, starting from £125,000 (or £300,000 for first-time buyers).

You must complete your home purchase before the 30th September to make use of the discounts available.

If you are looking to buy a property costing more than £500,000, you will pay the Stamp Duty rate based on the value of the property over £500,000. But this still means you’ll be saving a hefty £15,000 compared to the previous rates.

With big savings on Stamp Duty, your dream Greenwich Millennium Village home could be more affordable than you thought.

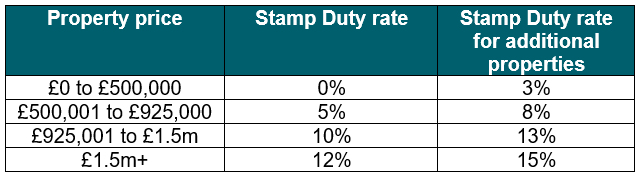

Temporary Stamp Duty rates until 30 June 2021

If you are purchasing a buy-to-let property or a second home (that is not a replacement for your main residence) that costs more than £40,000, you will still pay the additional 3% Stamp Duty surcharge.

The charge applies regardless of whether the property is new or second hand, and the amount you pay depends on the purchase price. Stamp Duty also applies to both freehold and leasehold properties and whether you are using a mortgage or buying with cash.